Ato Tax Deductions By Occupation

You must include all the income you received during the financial year in your tax return including salary and wages and allowances. Work-related travel attending morgues cemeteries etc.

Tax Deductions Favour Those Gaming The System Standard Deductions Might Help Abc News

A chef is a trained professional cook who is proficient in all aspects of food preparation.

Ato tax deductions by occupation

. Resource books including concordance theological dictionaries religious books and. Cost of travel related to visiting clients and attending training courses. Professional seminars courses conferences and workshops.Tax Deductions for Chefs. Cost of travel related to visiting parishioners and attending training courses. However these expenses must relate directly to the earning of income and accurate records or receipts may be required to back up a claim.

Others ensure that you will avoid expensive penalties and exorbitant interest payments. Work related deductions Claiming deductions for expenses that relate to your work as an employee 34 Work related car expenses 36 Work related travel expenses 43 Work related uniform occupation specific or protective clothing and laundry expenses 46 Work related self-education expenses 48 Other work related expenses 52 Other types of deductions. Expenses such as stationery telephone internet computers etc can be claimed separately.

Reference books technical journals and trade magazines related to your work as an accountant. Home office running expenses. Some of the tax tips will help you save both time and money when preparing your online tax return.

Employees guide for work expenses. Travel self-education home office and other To access the ATO guide for occupation specific deductions for Education Professionals click on the link below. Free Downloadable Checklist for employment-related tax deductions.

Typical tax deductions include. To save practitioners time explaining to clients what they can or cant include as deductions on their tax returns the ATO has developed a suite of occupation-specific guides. While the ATO is strict regarding what can and cannot be claimed Russell says there are deductions that thousands of Australians who do their own tax return are missing out on.

Below are a list of industries which have specific tax deductions that can be claimed. The ATOs Occupational Tax Deduction Guides can help you decide what tax claims can be made how they are calculated and what records are required to keep you legal. Professional seminars courses conferences and workshops.

Briefcases handbag man-bag or work bags. You can only claim a deduction for the work-related portion of an expense. All in all our tax.

The word chef is derived from the term chef de cuisine the director or head of a. Some of the tips and tricks below are designed to help you lower your taxes and achieve your maximum refund entitlement particularly those related to occupation-specific tax deductions. Individuals who choose to rent their vehicle or rooms in their homes through the sharing economy are entitled to certain deductions the ATO said.

Each occupation has a niche set of rules that govern the relevant tax entitlements and there are no guarantees when it comes to the minimum refund a taxpayer can expect in each industry. Typical tax deductions. It says these have been designed to help your clients understand what they can think about including or what is completely off the table as work-related expenses.

Mobile telephone and internet costs work related portion only. Our occupation and industry guides will help you work out what income and allowances you declare and the work-related expenses you can claim as a deduction. The Taxation office allows a deduction of 052 per hour to cover the expenses of heating cooling lighting and depreciation of general office furniture such as chair and desk.

Journals periodicals and magazines that have a content sufficiently connected to their employment. Find your occupation and click on the link to open a pdf that lists common deductions you can make on your taxes. Looking For Tax Deductions.

Typical tax deductions include. If you are employed as an Education Professional you may be entitled to claim a tax deduction for certain work-related expenses including. The Taxation office allows a deduction of 052 per hour to cover the expenses of heating cooling lighting and depreciation of general office furniture such as chair and desk.

Skill level Associate degree or diploma. Computer depreciation interest and repairs. Expenses such as stationery telephone internet computers etc can be claimed.

Teachers and education professionals. You cant claim a deduction for any part of an expense that is not directly related to earning your income or that is private. Tax deductions by Occupation and Industry.

Union and professional association fees. You can use the myDeductions tool in the ATO app to help keep track of your work.

Northern Territory Australian Taxation Office

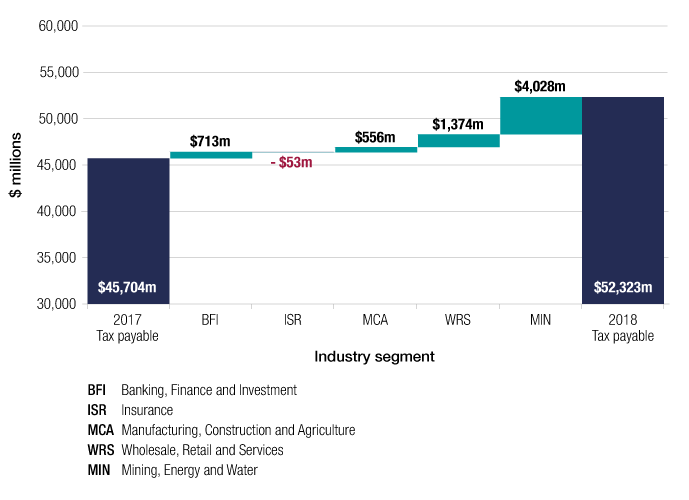

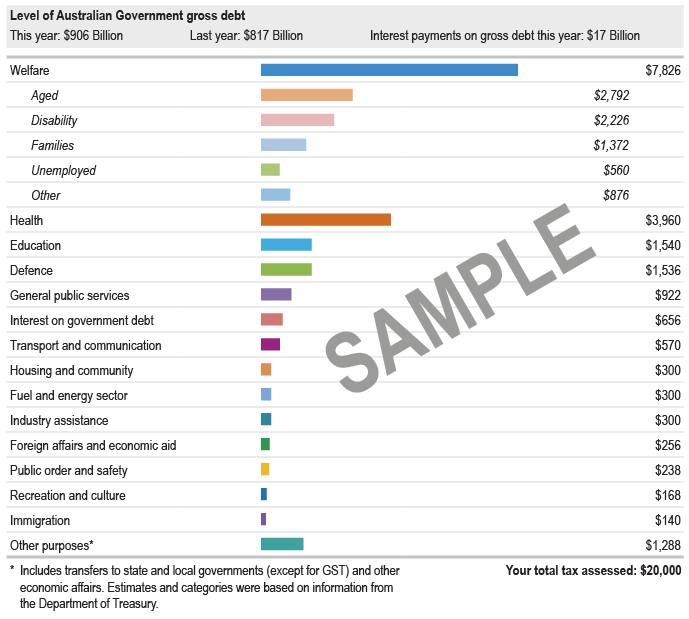

Total Income Tax Payable Australian Taxation Office

Tax Deductions Favour Those Gaming The System Standard Deductions Might Help Abc News

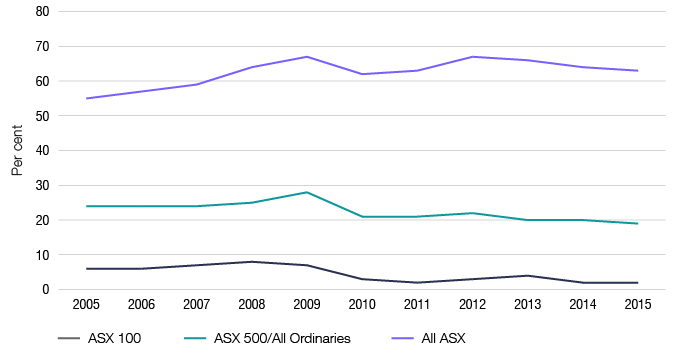

Net Losses And Nil Tax Payable Australian Taxation Office

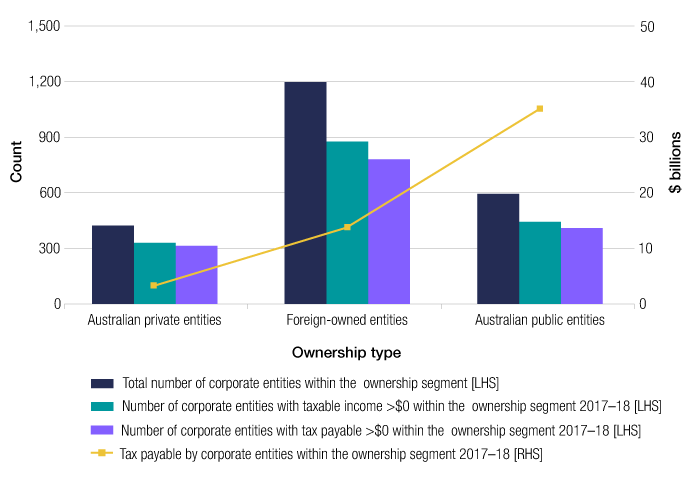

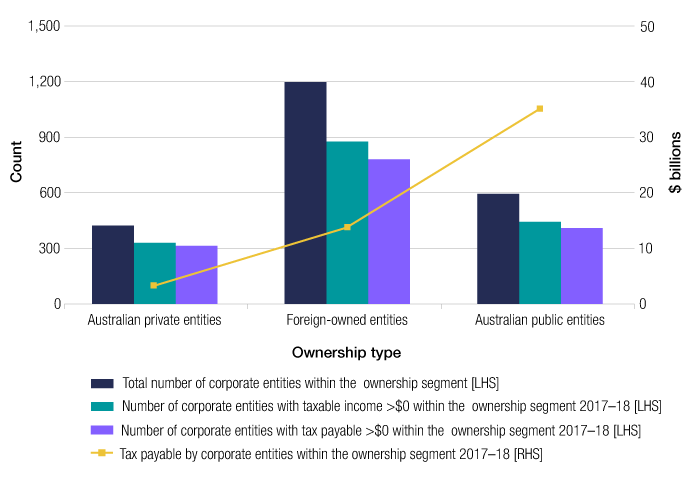

Ownership Australian Taxation Office

Tax Receipt Australian Taxation Office

Post a Comment for "Ato Tax Deductions By Occupation"