Non Conforming Loans Australia

If you have problems meeting the criteria of the banks loans then AMOs Non-Conforming loan is the solution. May overlook low credit rating.

Conforming Vs Non Conforming Loans

Non-conforming lenders began to be noticed in Australia in the late 1990s when many non bank lenders entered the market and began offering loans that did not fit the traditional bank criteria or box.

Non conforming loans australia

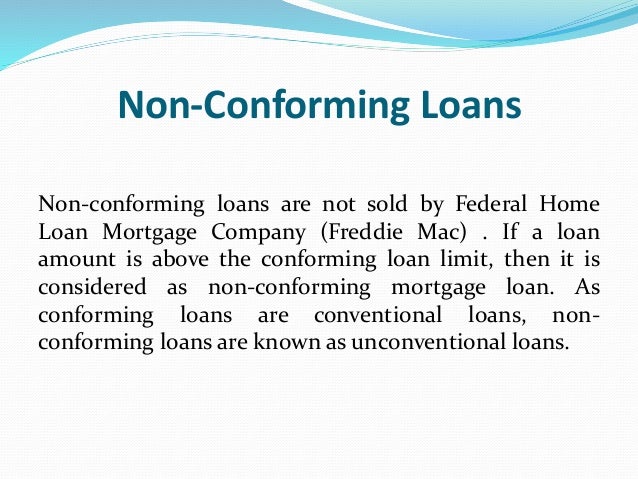

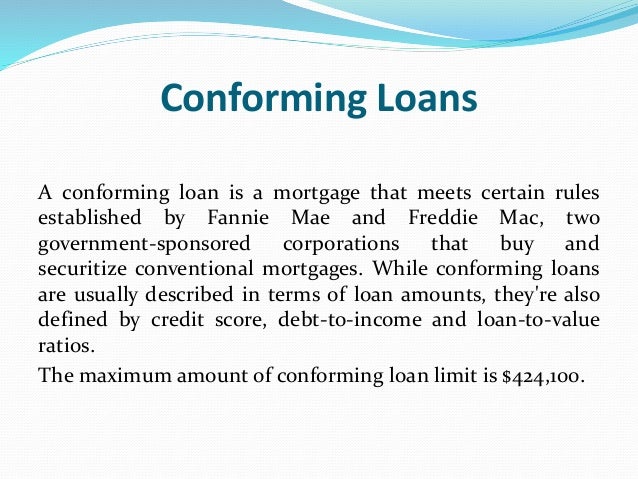

. Types Of Non-Conforming Loans. A non-conforming loan is a loan that fails to meet a banks criteria for funding. Some benefits of non-conforming loans include.A non-conforming home loan is a loan pitched at those who dont meet the typical home loan borrower criteria required by a big bank or major lender. As their name denotes lenders who offer loans which do not conform to traditional lending criteria are considered non conforming lenders. Someone else can buy the loan or the loan is too large to be considered a conforming loan.

Non-conforming isnt a commonly used term. To be able to lend to borrowers they usually charge a higher interest rate in recognition of the greater risk which may amount to thousands of dollars over the life of a loan. Many non-conforming lenders are privately owned with some even listed on the stock exchange in Australia or overseas.

If youre struggling to get the right loan come and speak to us. Reasons include the loan amount is higher than the conforming loan limit for mortgage loans lack of sufficient credit the unorthodox nature of the use of funds or the collateral backing it. Our team is experienced in non-conforming loans and have built an impressive network of lenders as well as our very own Private Funding Line to help those who may struggle to secure financing through the traditional avenues.

The Arthurmac team is also part of the MFAA and the AFCA. You may be considered to be a non-conforming borrower if you. Non Conforming Loans Could help you to purchase a home even with bad credit.

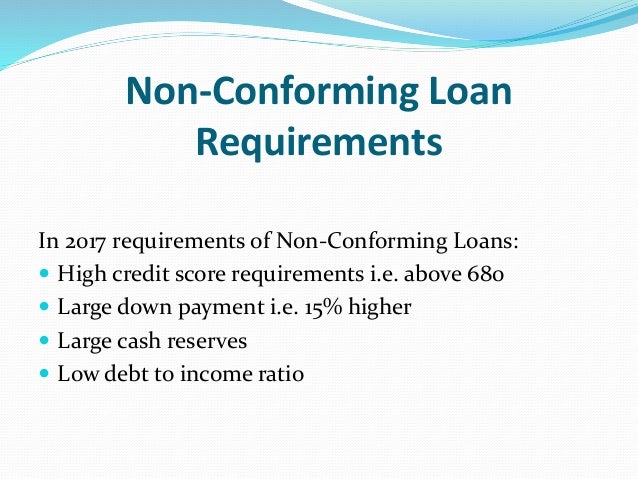

Non Conforming Loans A non-conforming loan is a loan that fails to meet bank criteria for funding. May be able to access a lower rate after a period of time where repayments have been made on time Cons. These may include applicants who have a poor credit history have previously declared bankruptcy or are self-employed.

This may include situations where the applicant has a poor credit history recently started a business or a new job been previously bankrupt has an ATO debt nearing retirement or recently arrived in Australia with no previous credit history. There are two main reasons why a loan might not conform. A non-conforming home loan is simply a term used for home loans that dont typically conform to the major banks standard loan criteria.

Are a new Australian resident and therefore cant verify your previous credit history. A non-conforming home loan is a loan offered to borrowers who dont meet the standard lending criteria of their bank or major lender. A non-conforming loan or non-bank loan is a loan offered to borrowers who dont meet the standard criteria required by banks and most other lenders.

Our panel of Lenders include - Redzed Pepper Home Loans Liberty Financial Latrobe Resimac Finloan Think Tank Victoria Mortgage Group and many more. What are the pros and cons of non conforming loans. Loans can be fully featured An excellent opportunity to repair a poor credit rating Future opportunity to revert or refinance to.

It is the opposite of whats called a prime home loan. A non-conforming loan is a loan that doesnt meet Fannie and Freddies standards for purchase. But if youve ever been declined for a home loan because youre self-employed and dont have the latest financial.

A larger deposit than is required for traditional loans. Up to 1500000 conditions apply. This could be because you have a bad credit history youre self-employed youve declared bankruptcy in the past or other reasons that might not qualify you for conventional mortgages and loans.

These loans typically come with a higher interest rate than a regular home loan based on the perceived risk of lending. NON-CONFORMING LOANS Non-conforming loans do not conform to a lenders typical lending criteria. We have access to a huge amount of loan packages so we can find the best loan for almost any situation.

Higher interest rate than traditional loans in recognition of higher level of risk. We work hard often 247 to get your loan approved by the time you need it. Well work with you to find a solution and get you back on track to achieve your goals.

Conforming Vs Non Conforming Loans

What Is A Non Conforming Loan Your Mortgage Australia

Conforming Vs Non Conforming Loans

Conforming Vs Non Conforming Loans

Non Conforming Loans Are Making A Comeback In Australia With 3 Billion Issued In 18 Months Business Insider

Amo Non Conforming Loans Mortgage Specialist Australia Amo

Conforming Vs Non Conforming Loans

Bad Credit Home Loans Mortgage Brokers Specialising In Non Conforming Home Loans

Post a Comment for "Non Conforming Loans Australia"