Boat Sales Tax Alabama

Air Bag Materials Used By Tire Manufacturers. North Carolinas boat sales tax.

Free And Printable Boat Bill Of Sale Form Rc123 Com Bill Of Sale Template Boat Bill Of Sale Bill Of Sale

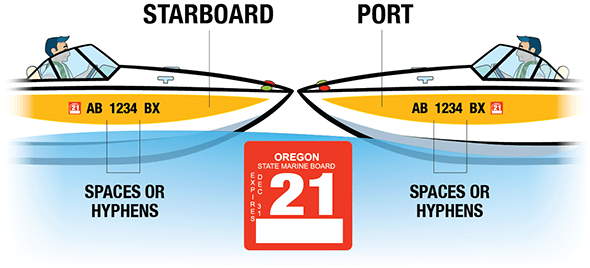

Boats newer than 1972 must have a 12 digit hull number.

Boat sales tax alabama

. MassTaxConnect is the recommended ST-6 filing and paying method. But if you finance it the bank is going to want the motor on the bill of sale. With valid temporary certificates of number.Rhode Island for example has no sales tax on boats. Alabama has 765 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. Prescription Drugs are exempt from the Alabama sales tax.

You will need to present a Bill of Sale for the boat. Raw rubber and other materials withdrawn from stock by a tire manufacturer for use in manufacturing air bags or water bags to be used by the manufacturer are to be included. The Alabama Marine Patrol Division does not require boat registration for a vessel.

Boat including jet skis Registration Requirements for new residents. A marina or storage facility is not an acceptable address for registration purposes. Florida caps the amount of boat sales tax at 18000 no matter the purchase price.

Now if you buy through a private seller you pay the sales tax at the DMV on just the boat and the trailer because they are registered vehicles and vessels. Act 98-192 known as the Local Tax Simplification Act of 1998 required each county and municipality to submit to the Department a list of any sales use rental lodgings tobacco or gasoline taxes. Alabama does not issue titles on boats.

If a 10000 boat is purchased tax-free and then brought into a jurisdiction with a 2 sales tax rate the buyer would become liable to pay Alabama a total of 4 - 2 10000 40000 in use tax. The Alabama Marine Police is responsible for enforcement of all Boating Safety laws as well as the setup and administration of these laws. Click below for a list of counties and municipalities that have opted-out of the Alabama Tax Tribunal.

States law even though that state may not allow credit for Alabama taxes paid under a requirement of Alabama law. If not collected by a registered boat recreational off-highway vehicle or snowmobile dealer a purchaser must file and pay a Sales or Use tax with Form ST-6. Sales tax will also be collected if necessary at the time of transfer.

The Alabama state sales tax rate is 4 and the average AL sales tax after local surtaxes is 891. Sales tax may be owed. AN OVERVIEW OF THE CASUAL SALES TAX I.

A discount is allowed if the tax is paid before the 20th day of the month in which the tax is due. Counties and cities can charge an additional local sales tax of up to 7 for a maximum possible combined sales tax of 11. When registering a boat for the first time in your name sales tax applies to the purchase price at the same local rates as applies to vehicles.

All taxes collected by licensing officials are remitted directly to. The Alabama Legislature amended this law to include county and municipal sales and use tax on boat purchases effective on and after July 1 1994. AL Boat Registration Exemptions.

ALABAMA DEPARTMENT OF REVENUE - SALES AND USE TAX RULES Code of Alabama 1975 Secti ons 40-23-31 and 40-23-83. Including city and county vehicle sales taxes the total sales tax due will be between 3375 and 4 of the vehicles purchase price. Counties and Municipalities Opt Out List.

Its fast easy and secure. Alabama collects a 2 state sales tax rate on the purchase of vehicles which includes off-road motorcycles and ATVs. ALABAMA State Sales Tax 2 State Taxes are Reciprocal County Taxes Varies 1 - 383 Total of 583 Maximum 334-242-1490 Alabama Dept.

Boat motors sold alone are taxable at the general rate of 4 percent of the total selling price. Sales and use tax must be paid prior to boat registration. New Yorkers for instance pay sales tax on only the first 230000 of a purchase priceor 825 percent in most counties.

Purpose of Tax. When it comes to flat rates the North Carolina sales tax on boats is 3 percent but capped at 1500 and in New Jersey its 33125 percent but in Florida its 6 percent and in Texas its 625 percent. The motor is considered part of the boat like a life jacket etc.

In addition to taxes car purchases in Alabama may be subject to other fees like registration. Nonautomotive boats sold alone are taxable at the general rate of 4 percent of the total selling price. Certificate of Payment of Sales or Use Tax for Boat Recreation or Snow Vehicle.

Credit must also be allowed for legally imposed sales or use taxes. The previous registration andor title. Sales tax must be paid in your county of residence or the county in which your boat is domiciled ie.

The sales tax discount consists of 5 on the first 100 of tax due and 2 of. A motorboat is a boat with one or more built-in motors or a boat with an outboard type motor. If you arent sure whether your boat qualifies call the Marine Patrol Division boat registration number at 334 517-2950.

At least that is the way I understand it. Owner must appear in person or provide a power of attorney to whoever is coming in.

Used Boats For Sale In Miami Fl Used Boat Sales

Flying Cloud Al Capone Boat Reminder It S Getting Close To Tax Time Boat Classic Boats Classic Wooden Boats

How Houseboats Work House Boat Boat House Interior Houseboat Living

Yacht Sales Contracts Boat Taxes And Duties Some Basic Tips 1 Catamaran Resource

Boats Calhoun County Commissioner Of Licenses

Post a Comment for "Boat Sales Tax Alabama"