pay national insurance

Insurance Type Get Saved Quotes. You pay your Class 1A National Insurance on work benefits that you give to your employees separately.

1944 American National Insurance Payment Ledger Booklet 00114 Ebay National Insurance Booklet Insurance

All the customers of National Insurance Company are eligible to make an online payment.

. It is mandatory to take motor insurance policy for all vehicle owners as per Motor Vehicle Act 1988It safeguard against accidental damage or theft of the vehicle and also safeguard against third party legal liability for bodily injury andor property damageIt also provides Personal Accident cover for owner driver occupants of the vehicle. To keep your personal data safe Penn National Insurance does not call or email active policyholders to request personal account information or payment. Online transactions are more secured and convenient. So basically everyone who works in the UK.

The National Insurance rate you pay depends on how much you earn and is made up of. For employed people National Insurance NI threshold is 9569 for the tax year 2021-22. You pay National Insurance when youre employed and earning more than 9568 a year or 184 per week. There are various limits governing what employees pay but the main threshold for employers is 732 a month 169 a week - once your staff earn above that you must start paying employers National Insurance for them.

From July 2022 the lower threshold for paying Class 1 NICs will rise to. 12 of your weekly earnings between 184 and 967 202122 2 of your weekly earnings above 967. It takes just a few minutes to register. How National Insurance is changing.

You can easily renew your current National Insurance policy online within a few minutes. Kentucky National Insurance PO. The threshold at which employees and the self-employed start to pay national insurance contributions will rise from 9880 to 12570 a year. All you need is a Policy Number the Insureds Name and Date of Birth to have access to policy information 24-hours a day.

National Insurance which is often abbreviated to NI or NIC National Insurance Contribution or NINO National Insurance Number is money that is paid to Her Majestys Revenue and Customs HMRC by employers employees and those who are self-employed. You may want to continue to pay in order to achieve full state pension. An employee earning above 184 a week. People pay National Insurance to qualify for certain benefits and the state pension.

Ad Is Your Insurance Bill Due Soon Pay Your Bill Securely with doxo. Self-employed and making a profit of 6515 or more a year. Penn National Insurances Customer Contact Center representatives do not initiate outbound telemarketing calls. The lower earnings limit will rise by 3000 bringing it in line with the income tax threshold.

2022 Stingray System. All fields are required. Log in to pay your Life Health or Annuity bill. You have lived in the UK continually for 3 years before the period for which NIC is to be paid.

If you have been impacted by the recent storms file a claim online. National insurance is a tax paid on earnings by the employed and employees and paid by the self-employed on profits. National General Insurance offers Auto RV and Home Insurance. This is an increase of 2690 in cash terms and is.

And it only takes a few minutes. You can still pay National Insurance contributions even if your not working or leave the UK. This means you will not pay NICs unless you earn more than 12570 up from 9880. If youre self-employed your rates will go up from 9 and 2 to 1025 and 325.

You pay it until you reach the State Pension Age. NIC earnings thresholds can be calculated weekly or monthly. PAYE Settlement Agreements are also paid separately. This means if your income is 9568 or below during the 2021-22 tax year then you are exempted from you do not have to pay paying National Insurance.

Rishi Sunak announced that the threshold at which you start paying National Insurance will change from July. The national insurance rise means that for employees instead of paying 12 on earnings up to 50270 and 2 on anything above that youll pay 1325 and 325 respectively. Complete the form below to make a payment on your account. In order to pay voluntary contributions you must comply with one of the following.

After April 2023 the levy will be split off from national insurance and shown on. National insurance pays for the state pension jobseekers allowance employment and support. It was introduced back in 1911 to. National Insurance allows online payment of insurance premium through their site without their branch office.

Manage My NatGen Policy Quick Pay Get ID Cards Report a Claim View Policy Documents At National General we believe you should never have to face a catastrophe alone. Employers National Insurance thresholds 202021. Below we look at some questions you may have about the rise. You pay it if you are aged over 16 earn above 184 a week are self-employed and make a profit of 6515 a year or more.

Box 55126 Lexington KY 40555-5126 Phone. Self-employed people earning more than 6515 also pay national insurance contributions. Give us a call. Or call 1-800-462-2123.

First Visit to Liberty Nationals eService Center. Free online quotes for the insurance coverage you want.

Self Employed National Insurance What To Pay If You Re Self Employed Https Www Simplybusiness Co Uk National Insurance Refinance Mortgage Mortgage Advice

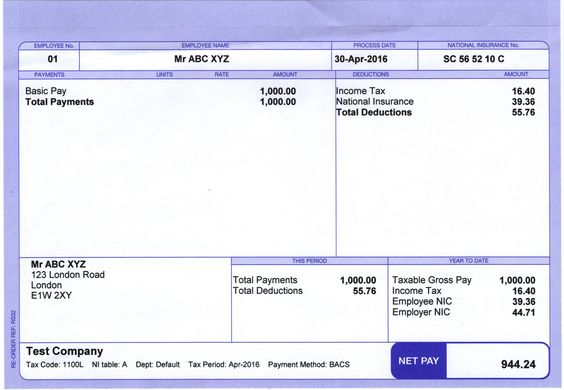

Do You Need Weakly Or Monthly Payslips Or P60 Documents Payroll Template National Insurance Number Unit Rate

Important Things In Your Payslips Need To Check Payroll Template Payroll Software National Insurance Number

How Do I Get A National Insurance Number Everything You Need To Know National Insurance Number National Insurance Insurance

Understanding The Difference Between P45 P60 Payslips Online Tax Forms Income Tax National Insurance Number

Post a Comment for "pay national insurance"